Wayne County Mi Real Estate Records

Register of Deeds

The Register of Deeds announces new fee schedule effective January 1, 2026.This is the first fee increase at this office since 1996.

https://www.waynecountymi.gov/Government/Elected-Officials/Register-of-DeedsSearch Services and Copy Requests

Veterans and current military personnel may receive a search of their own real estate property ... Wayne County, Michigan | Powered by Granicus. Ready.

https://www.waynecountymi.gov/Government/Elected-Officials/Register-of-Deeds/Search-Services-and-Copy-RequestsRegister of Deeds List By Michigan County

Wayne County Register of Deeds International Center 400 Monroe, 7th Floor ... State of Michigan Mi.gov Home Policies Accessibility ...

https://www.michigan.gov/taxes/collections/register-of-deedsPay Taxes Online Treasurer

Share: Font Size: Pay Taxes Online Property Search Cannot find address ? Enter the name of the street without the ending ‘Street’ or ‘Avenue’. Enter the first three letters of the street name and all the streets starting with those letters will be searched.

https://pta.waynecounty.com/

Document Recording

The Register of Deeds announces new fee schedule effective January 1, 2026. This is the first fee increase at this office since 1996. Fee for recording any deed ...

https://www.waynecountymi.gov/Government/Elected-Officials/Register-of-Deeds/Document-RecordingLegal News > Your source for information behind the law

2026 Wayne County Delinquent Tax Liens Download PDF Version of 2026 Wayne County Delinquent Tax Liens Click here to go to Wayne County Treasurer's Websiteheadlines Detroit headlines National - Understanding women in their lives is important for men’s happiness, divorce lawyer says in new book - ACLU and BigLaw firm use ‘Orange is the New Black’ in hashtag effort to promote NY jail reform - Federal jury awards $120M to...

https://www.legalnews.com/Home/Tax_LiensEnjoy the holidays . . . and as you prepare for the new year, the City of Detroit is offering more ways to pay your property taxes. You can pay while you shop, pay while you scroll, pay almost anywhere, anytime! Discover the payment method that works best for you at www.PayDetroit365.com. Important Winter Property Tax dates to remember: January 15, 2026 - Full Winter and Summer and Second Installment property taxes are due (Pay by this date to avoid interest and penalties.) January 16, 2026 - In

Enjoy the holidays . . . and as you prepare for the new year, the City of Detroit is offering more ways to pay your property taxes. You can pay while you...

https://www.facebook.com/CityofDetroit/videos/detroit-announces-new-ways-to-pay-property-taxes-key-2026-dates/714766134615060/

Wayne County Treasurer Website

Regarding Mailed Property Tax Payments and USPS Postmarks Taxpayers who choose to mail their property tax payment should be aware of recent changes (See Here) in United States Postal Service (USPS) postmark practices that may affect how payment timeliness is determined.

https://waynecountytreasurer.org/

Wayne County Register of Deeds City of Detroit

- Departments Departments - Back - Airport, Coleman A. Young International - Buildings, Safety Engineering and Environmental Department - Civil Rights, Inclusion & Opportunity Department - Department of Public Works - Department of Appeals and Hearings - Department of Innovation and Technology - Department of Neighborhoods - Detroit Building Authority - Detroit Department of Transportation - Detroit Fire Department - Detroit Health Department ...

https://detroitmi.gov/node/9756

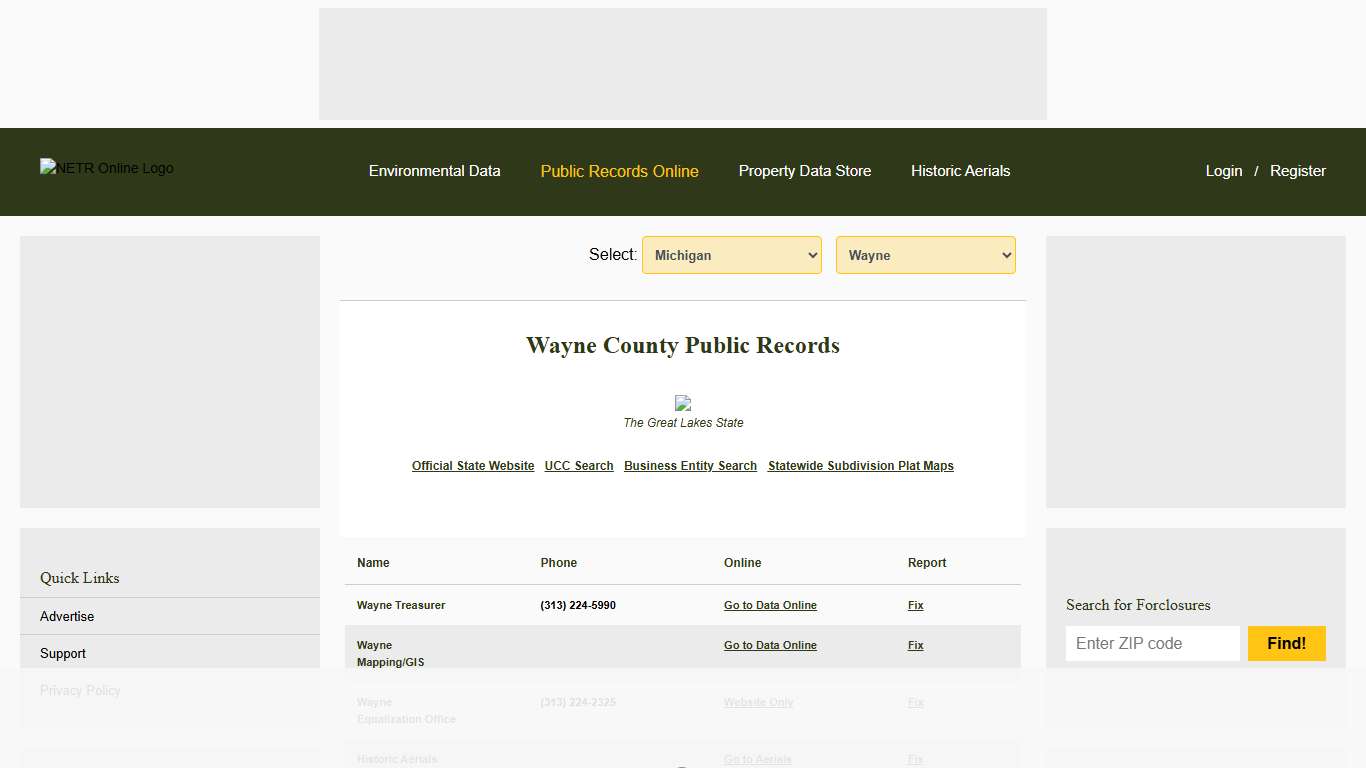

NETR Online • Wayne • Wayne Public Records, Search Wayne Records, Wayne Property Tax, Michigan Property Search, Michigan Assessor

Select: Wayne County Public Records The Great Lakes State Wayne Treasurer (313) 224-5990 Wayne Equalization Office (313) 224-2325 Wayne City/Township Directory Wayne Register of Deeds (313) 224-5850 Wayne NETR Mapping and GIS Help us keep this directory a great place for public records information. Submit New Link Products available in the Property Data Store...

https://publicrecords.netronline.com/state/MI/county/wayne

Property Tax Information - Wayne County, Michigan

Property Tax Information The Wayne County Treasurer's Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. Property taxes not paid to the local Treasurers office by the last day in February become delinquent on the following March 1.

https://www.waynecountymi.gov/Government/Elected-Officials/Treasurer/Property-Tax-Information

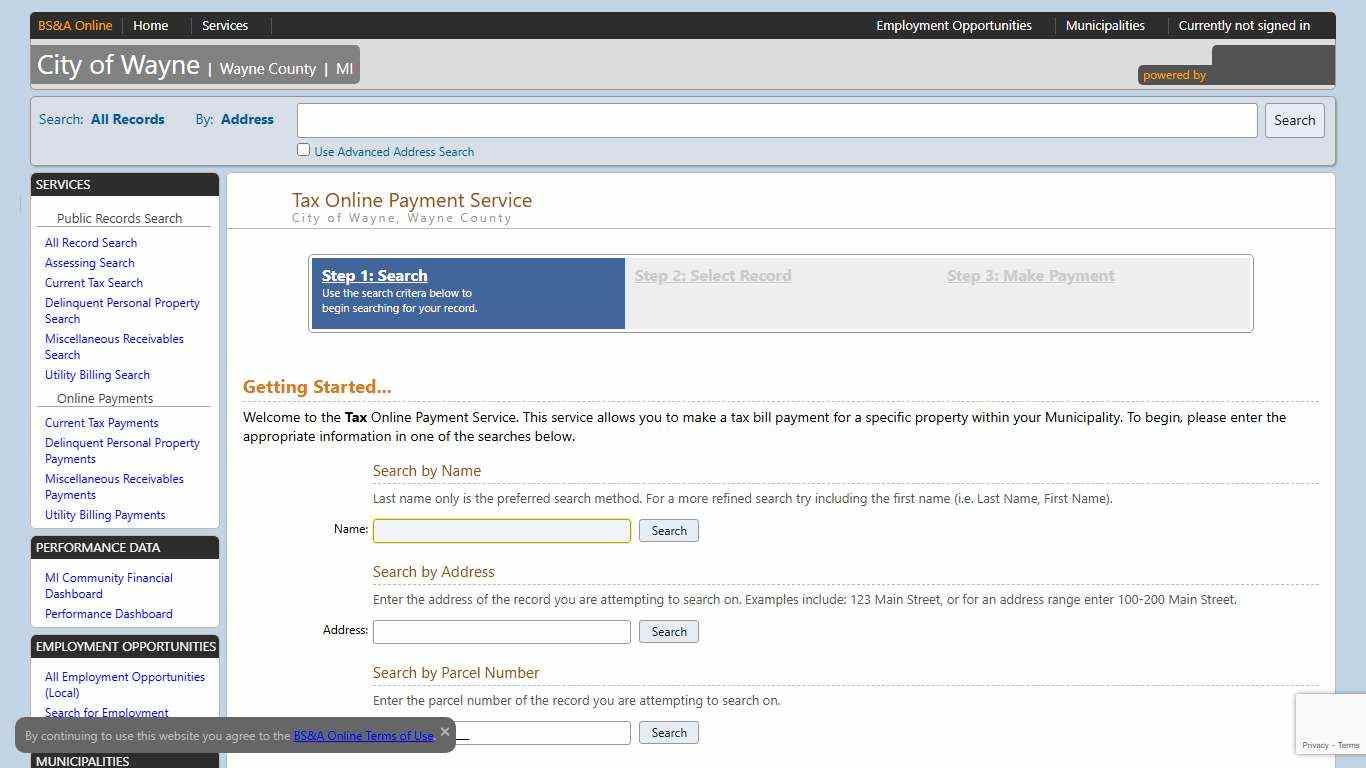

Online Payment Tax Search City of Wayne BS&A Online

Step 1: SearchUse the search critera below to begin searching for your record. Step 2: Select Record Step 3: Make Payment Getting Started... Welcome to the Tax Online Payment Service. This service allows you to make a tax bill payment for a specific property within your Municipality.

https://www.bsaonline.com/OnlinePayment/OnlinePaymentSearch?PaymentApplicationType=4&uid=683

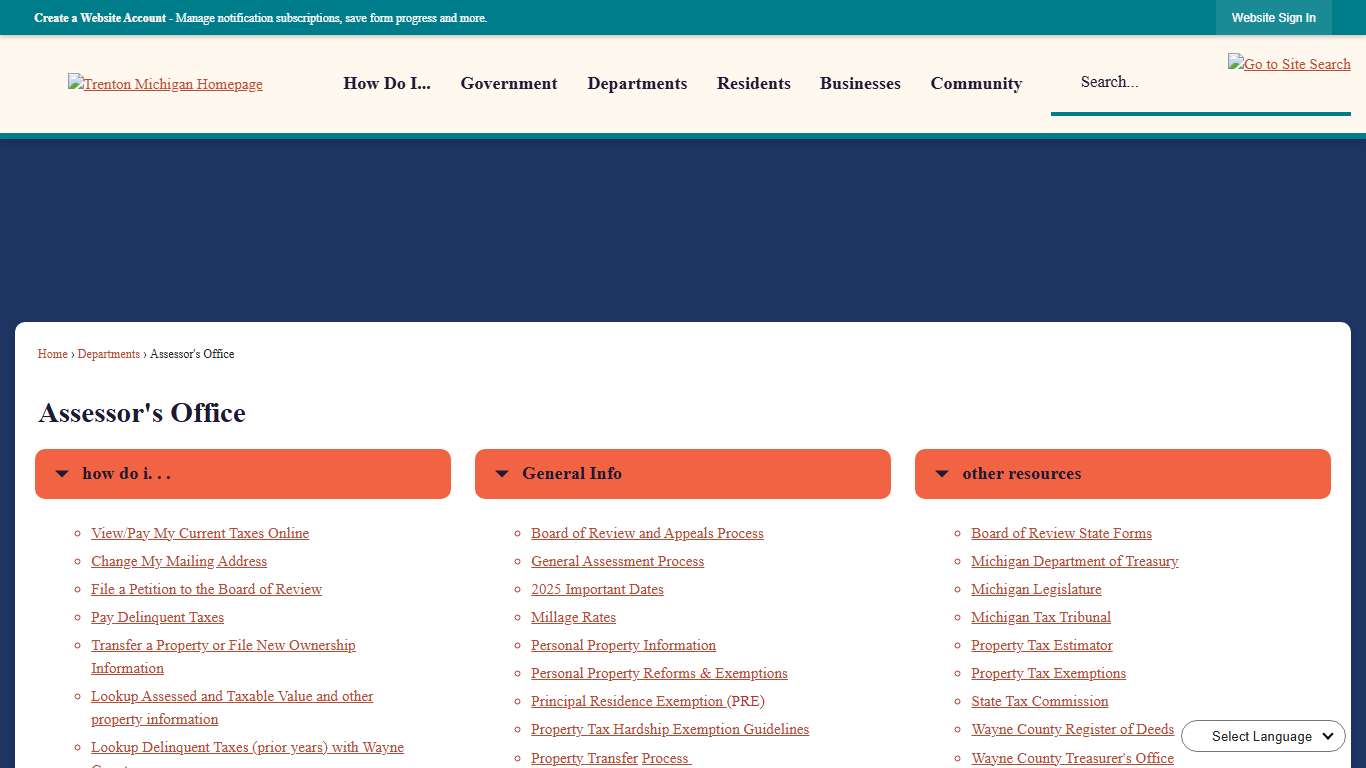

Assessor's Office Trenton, MI

Assessor's Office Joanie Barnett, Assessor; Jeff Wagar, Prior Board Member; and James Anderson, Board Member Department Hours The normal business hours for the Assessor's office are Monday through Friday between 8:30 am to 5:00 pm. To confirm availability, please call (734)675-6810.

https://www.trentonmi.org/157/Assessors-Office

Assessor's Office Canton Township, MI - Official Website

Assessor's Office The Assessing Office maintains all assessment records for residential, commercial and industrial properties within the Township. Information available through our Online Property Inquiry includes: parcel number and address, legal description, general building description, square footage, year built and building sketch.

https://www.cantonmi.gov/772/Assessors-Office